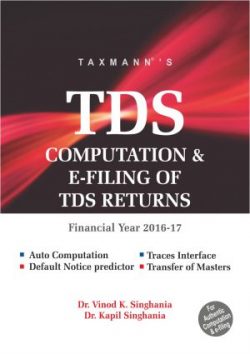

TDS Computation and e-Filing of TDS Returns (Single User) 2017 by Vinod K Singhania & Kapil Singhania

₹4,500.00 Original price was: ₹4,500.00.₹3,600.00Current price is: ₹3,600.00.

Category: SOFTWARE AND SUBSCRIPTIONS

TDS Computation and e-Filing of TDS Returns (Single User)

Also Available Multi User Version (5 Users Licence)

- Traces login interface integrated in the software – (Requisition of .tds or Forms 16A & 27D)

- Check for Default Notice -Corrective actions can be taken in advance and file fully complaint e-TDS statement. Save additional cost in interest on delayed deposit and delayed deduction. Save yourself from trouble of attending to notices and filing appeals

- Bulk PAN verification – (At the time of filing and through traces website also)

- All certificates validations through TRACES in single shot

- Excel import and export feature for preparing correction statement with lesser effort

- Option to auto download .csi file duringfile validation

- Auto Generation of Form 12BA

- Unlimited Deductors/Companies, Deductee & Employees

- Generate almost all forms of eTDS/eTCS Return i.e., 12BA, 24Q,26Q,27Q&27EQ

- Instant display of validation errors

- Multiple form generation (Including summary report)

- Transfer of Masters from one company to another company

- Quick access to Ready Reckoner relevant extracts with regards to TDS provisions

- Unique Help features, switch to any provision on a single click (F2)

- Import Data from Excel files. (For Masters only)

- FVU file generation for return submission injust one click

- Auto calculation of all taxable allowances, perquisites, gratuity, pension, Leave encashment, relief under section 89, KVP/NSC Interest, PF calculation and tax thereon

- Multiuser functionality in LAN atmosphere

System Requirements

Software and Hardware

PC Processor : 1.5 GHz or higher

Operating System : Windows XP (with SP3)/Windows 2000/Windows Vista/Windows 7(32 Bit/64 Bit)/Windows 8

RAM : 512 MB or higher (Recommended 1 GB or higher)

CD Rom Drive : 24X or more

Hard Drive Space required : 1GB or Higher

System Setting

For better execution, your system settings should be as follows:

Regional setting : English (United States)

Resolution : 1024 by 768 pixels

Color : High Colors 16/24 Bit

Date Setting : dd/mm/yyyy (Go to Control Panel – Regional Settings – Date – Short date

format) and date separator should be – /

| Binding | dvd |

|---|---|

| Edition | Financial Year (2016-17) |

| Publisher | Taxmann |

Related products

-10%

-10%

Rated 3.00 out of 5

-10%

-10%

-10%

-10%

-10%

Rated 2.50 out of 5

-10%

TDS Computation and e-Filing of TDS Returns (Multi User) 2017 by Vinod K Singhania & Kapil Singhania