-

×

MCQs and Integrated case Studies on Advanced Auditing & Professional Ethics, 2020 by Pankaj Garg

1 × ₹476.00

MCQs and Integrated case Studies on Advanced Auditing & Professional Ethics, 2020 by Pankaj Garg

1 × ₹476.00 -

×

Taxman-The Tax Law Weekly with 2 Daily e-Mail Services, 2017 by Taxmann

1 × ₹8,010.00

Taxman-The Tax Law Weekly with 2 Daily e-Mail Services, 2017 by Taxmann

1 × ₹8,010.00 -

×

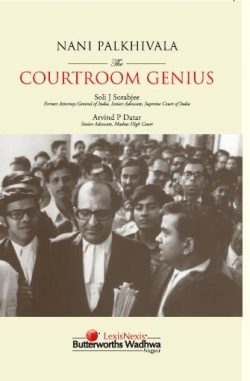

LexisGreen™ Corporate Pack - A Ramaiya Guide to the Companies Act, 18/e with Amendments updated up to July 2016 by Ramaiya (Revised by Arvind P Datar & S. Balasubramanian)

1 × ₹5,596.00

LexisGreen™ Corporate Pack - A Ramaiya Guide to the Companies Act, 18/e with Amendments updated up to July 2016 by Ramaiya (Revised by Arvind P Datar & S. Balasubramanian)

1 × ₹5,596.00 -

×

DIRECT TAXES READY RECKONER with Tax Planning, 2022 by Mahendra B. Gabhawala

1 × ₹1,436.00

DIRECT TAXES READY RECKONER with Tax Planning, 2022 by Mahendra B. Gabhawala

1 × ₹1,436.00 -

×

Basic Corporate Accounting (B.com) Choice based Credit System(CBCS) 2017 by K.M Bansal

2 × ₹540.00

Basic Corporate Accounting (B.com) Choice based Credit System(CBCS) 2017 by K.M Bansal

2 × ₹540.00 -

×

Depository Operations (National Institute Of Securities Markets) (NISM) 2017

1 × ₹200.00

Depository Operations (National Institute Of Securities Markets) (NISM) 2017

1 × ₹200.00 -

×

Technology Laws Decoded, 2017 by N S Nappinai

1 × ₹1,276.00

Technology Laws Decoded, 2017 by N S Nappinai

1 × ₹1,276.00

Capital Gains Tax – Law and Practice (As amended by the Finance Act, 2017) by T G Suresh

₹750.00 Original price was: ₹750.00.₹600.00Current price is: ₹600.00.

Category: Other Law Books

Capital Gains Tax – Law and Practice (As amended by the Finance Act, 2017)

Capital Gains Tax — Law and Practice comprehensively covers legal and practical aspects governing taxation of short term and long term capital gains as provided under Chapter IV(E) of the Income-tax Act, 1961. The third edition has been thoroughly revised and updated in view of amendments brought in by the Finance Act, 2017.

Salient Features:-

- Incorporates all relevant Notifications, Circulars and Schemes up to March 2017

- Special emphasis on Business Restructuring transactions, Real Estate transactions, Cross Border transactions and transactions in Securities

- Judicial view has been examined and reconciled at appropriate places

- Practical scenarios and illustrations discussed for better understanding

- Apex Court’s decisions/interpretation are appropriately highlighted and considered

- Comprehensive analysis on transactions by non-residents and relevant tax implications

- Includes TDS and Advance Tax provisions

- Drafted like a ‘capital gains reckoner’ for easier reference

- Controversial provisions are reconciled appropriately to reduce/avoid litigation

This book is a must have for tax professionals seeking solutions for technical issues relating to capital gains to advise their clients.

| Binding | Softbound |

|---|---|

| Edition | 3rd Edition 2017 |

| ISBN | 9788131250839 |

| Publisher | Lexis Nexis |

Be the first to review “Capital Gains Tax – Law and Practice (As amended by the Finance Act, 2017) by T G Suresh” Cancel reply

Related products

-7%

Rated 2.25 out of 5

-20%

-20%

-20%

-20%

-20%

-20%

-20%

Rated 2.60 out of 5

Taxman-The Tax Law Weekly with 2 Daily e-Mail Services, 2017 by Taxmann

Taxman-The Tax Law Weekly with 2 Daily e-Mail Services, 2017 by Taxmann  LexisGreen™ Corporate Pack - A Ramaiya Guide to the Companies Act, 18/e with Amendments updated up to July 2016 by Ramaiya (Revised by Arvind P Datar & S. Balasubramanian)

LexisGreen™ Corporate Pack - A Ramaiya Guide to the Companies Act, 18/e with Amendments updated up to July 2016 by Ramaiya (Revised by Arvind P Datar & S. Balasubramanian)  DIRECT TAXES READY RECKONER with Tax Planning, 2022 by Mahendra B. Gabhawala

DIRECT TAXES READY RECKONER with Tax Planning, 2022 by Mahendra B. Gabhawala  Basic Corporate Accounting (B.com) Choice based Credit System(CBCS) 2017 by K.M Bansal

Basic Corporate Accounting (B.com) Choice based Credit System(CBCS) 2017 by K.M Bansal  Depository Operations (National Institute Of Securities Markets) (NISM) 2017

Depository Operations (National Institute Of Securities Markets) (NISM) 2017  Technology Laws Decoded, 2017 by N S Nappinai

Technology Laws Decoded, 2017 by N S Nappinai

Reviews

There are no reviews yet.