-

×

Professional’s Guide to GST - From Ideation to Reality, 2017 by Abhishek A Rastogi

1 × ₹876.00

Professional’s Guide to GST - From Ideation to Reality, 2017 by Abhishek A Rastogi

1 × ₹876.00 -

×

C R Datta on Company Law: Cumulative Supplement

1 × ₹876.00

C R Datta on Company Law: Cumulative Supplement

1 × ₹876.00 -

×

GST Made Easy - Answer To all Your Queries on GST, 2019 by Arpit Haldia

1 × ₹556.00

GST Made Easy - Answer To all Your Queries on GST, 2019 by Arpit Haldia

1 × ₹556.00 -

×

Company Law, 2017 by Tejpal Sheth

1 × ₹476.00

Company Law, 2017 by Tejpal Sheth

1 × ₹476.00 -

×

COMPANIES ACT, 2013 with RULES, 2020 by Bharat's

1 × ₹1,160.00

COMPANIES ACT, 2013 with RULES, 2020 by Bharat's

1 × ₹1,160.00 -

×

CORPORATE & OTHER LAWS (For Nov., 2018 & May 2019 exams) 2018 by CS AMIT VOHRA • CS RACHIT DHINGRA

1 × ₹520.00

CORPORATE & OTHER LAWS (For Nov., 2018 & May 2019 exams) 2018 by CS AMIT VOHRA • CS RACHIT DHINGRA

1 × ₹520.00 -

×

Practical Guide on TDS and TCS, 16E, 2017 By Fca Ca G Sekar

1 × ₹719.20

Practical Guide on TDS and TCS, 16E, 2017 By Fca Ca G Sekar

1 × ₹719.20 -

×

Companies Act with Rules (Paperback Pocket Edition) 2019 by Taxmann

1 × ₹716.00

Companies Act with Rules (Paperback Pocket Edition) 2019 by Taxmann

1 × ₹716.00 -

×

INCOME TAX LAW VOL. 6 (Sections 139 to 181) 2014 by CHATURVEDI & PITHISARIA’S

1 × ₹1,960.00

INCOME TAX LAW VOL. 6 (Sections 139 to 181) 2014 by CHATURVEDI & PITHISARIA’S

1 × ₹1,960.00

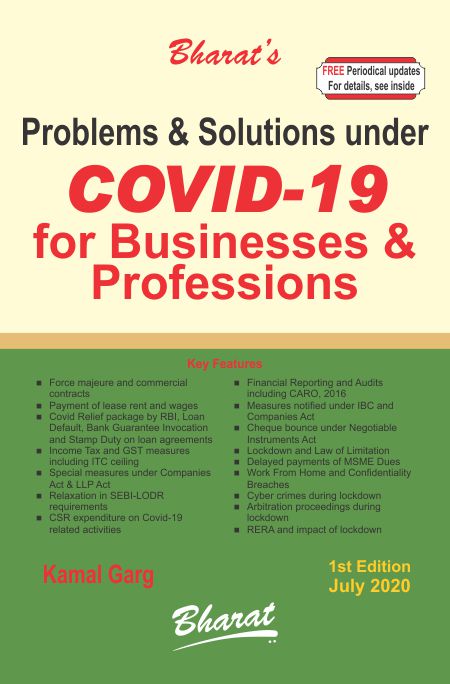

Problems & Solutions under COVID-19 for Businesses & Professions 2020 by CA. Kamal Garg

₹995.00 Original price was: ₹995.00.₹796.00Current price is: ₹796.00.

SKU: 9789386920676

Category: Direct Tax

Problems & Solutions under COVID-19 for Businesses & Professions

Chapter 1 Lockdown due to COVID-19 Pandemic — whether Force Majeure Event

Chapter 2 Doctrine of frustration — incapability to perform contractual obligation under Covid-19 circumstances

Chapter 3 Compensation or Damages for breach of contract under Covid-19 circumstances

Chapter 4 Lease Contracts whether impacted due to Covid-19 outbreak

Chapter 5 Payment of Wages during lockdown

Chapter 6 Sale of pledged shares during Covid-19 circumstances

Chapter 7 Law of Limitation under Covid-19 circumstances – Supreme Court’s Order

Chapter 8 Limitation period of demand notices in cheque bounce cases

Chapter 9 CSR expenditure on Covid-19 related activities

Chapter 10 Transfer of unpaid or unclaimed money and shares to IEPF

Chapter 11 Special Measures under Companies Act, 2013 and Limited Liability Partnership Act, 2008 in view of Covid-19 breakout

Chapter 12 Approval of Annual Financial Statements, Board Report, etc. – matters allowed through video conferencing or other audio visual means

Chapter 13 MCA allows companies to hold EGMs through Video Conferencing or Other Audio Visual Means

Chapter 14 Holding of Annual General Meetings by Companies

Chapter 15 Various requirements and relaxations introduced by SEBI due to Covid-19 Pandemic

Chapter 16 Taxation, Corporate Laws and Insolvency Law Measures announced during Covid-19 Outbreak

Chapter 17 Residential Status and New Procedure for Registration, Approval, etc. of certain entities under Income Tax Act, 1961

Chapter 18 Reduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)

Chapter 19 Relief package under Pradhan Mantri Garib Kalyan Yojana for the poor to help them fight the battle against Corona Virus

Chapter 20 Atmanirbhar Bharat Announcements

Chapter 21 Due Dates under Income Tax Act

Chapter 22 Reliefs and Issues under GST due to COVID-19

Chapter 23 Various relaxations and issues under IBC, 2016

Chapter 24 RBI’s Covid-19 Relief Package

Chapter 25 SEBI Listing Regulations – Disclosure Requirements arising due to Covid-19 Outbreak

Chapter 26 Covid-19 impact on Financial Reporting

Chapter 27 CARO, 2016 and considerations arising due to Covid-19 outbreak

Chapter 28 Electronic means of Communication, Quality Control and the Auditor

Chapter 29 Related Party Transactions – a new muddle under Covid-19 outbreak

Chapter 30 Loan Agreements and Stamp Duty during Covid-19 period

Chapter 31 Delayed Payments to Micro, Small and Medium Enterprises

Chapter 32 Relief Package for MSME Sector

Chapter 33 Guaranteed Emergency Line of Credit

Chapter 34 Covid-19 and RERA

Chapter 35 Arbitration Proceedings under Covid-19 circumstances

Chapter 36 Confidentiality and Work from Home during Covid-19 Lockdown

Chapter 37 COVID-19 outbreak and various scams

Problems & Solutions under COVID-19 for Businesses & Professions

Appendix 1 Circulars issued by Ministry of Home Affairs

Appendix 2 1. The Epidemic Diseases Act, 1897

- The Disaster Management Act, 2005

Appendix 3 Guidelines for Phased Re-opening (Unlock 1)

Appendix 4 Guidelines for Phased Re-opening (Unlock 2)

https://bookskhoj.com/product/taxation-laws-2020-by-dr-jyoti-rattan/

| Edition | 1st edn., 2020 |

|---|---|

| ISBN | 9789386920676 |

| Publisher | BHARAT LAW PVT. LTD. |

Be the first to review “Problems & Solutions under COVID-19 for Businesses & Professions 2020 by CA. Kamal Garg” Cancel reply

Related products

-20%

-15%

-20%

-30%

Rated 2.45 out of 5

-20%

-20%

-20%

-20%

C R Datta on Company Law: Cumulative Supplement

C R Datta on Company Law: Cumulative Supplement  GST Made Easy - Answer To all Your Queries on GST, 2019 by Arpit Haldia

GST Made Easy - Answer To all Your Queries on GST, 2019 by Arpit Haldia  Company Law, 2017 by Tejpal Sheth

Company Law, 2017 by Tejpal Sheth  COMPANIES ACT, 2013 with RULES, 2020 by Bharat's

COMPANIES ACT, 2013 with RULES, 2020 by Bharat's  CORPORATE & OTHER LAWS (For Nov., 2018 & May 2019 exams) 2018 by CS AMIT VOHRA • CS RACHIT DHINGRA

CORPORATE & OTHER LAWS (For Nov., 2018 & May 2019 exams) 2018 by CS AMIT VOHRA • CS RACHIT DHINGRA  Practical Guide on TDS and TCS, 16E, 2017 By Fca Ca G Sekar

Practical Guide on TDS and TCS, 16E, 2017 By Fca Ca G Sekar  Companies Act with Rules (Paperback Pocket Edition) 2019 by Taxmann

Companies Act with Rules (Paperback Pocket Edition) 2019 by Taxmann  INCOME TAX LAW VOL. 6 (Sections 139 to 181) 2014 by CHATURVEDI & PITHISARIA’S

INCOME TAX LAW VOL. 6 (Sections 139 to 181) 2014 by CHATURVEDI & PITHISARIA’S

Reviews

There are no reviews yet.